When the Adderall-addled Sam Bankman-Fried (SBF) lost control of his crypto-trading platform after defrauding users, many had their priors confirmed.

Crypto bad! they cried.

This, of course, is rather like saying DOTCOM bad! in 2001 or, post-Enron, -Bernie Madoff, or -Elizabeth Holmes capitalism bad! Of course, the Web survived, and the mixed economy went trundling along.

Hypostatization is too big a word for the crypto bad group. “Crypto” is not a concrete thing that can be evaluated as such. You have to look at the particulars, such as the value of what technology, represented by which token, traded on what exchange—centralized or decentralized—run by which actors, and by what means.

For example, FTX was a centralized cryptocurrency exchange. That’s very different from a decentralized exchange like Sushiswap. Centralized, custodial Web2 exchanges are convenient, but that makes them vulnerable. That’s why OGs always caution users to self-custody.

To be clear, bitcoin is not an exchange. Nor is it a Ponzi scheme. It is a scarce, fully decentralized digital commodity you can buy on an exchange, but would be unwise to store there. Again: “not your keys, not your coins.” SBF took advantage of this fact, as the government will.

Yes, “crypto” has attracted scam artists, hackers, schemers, and other ne’er-do-wells. But so has traditional finance. In fact, I was recently the victim of a card-testing scam. Wherever there is value, there will be scumbags: private criminals and public predators.

Though scumbags are scum, their existence is a selection pressure for the crypto ecosystem.

So, when people say crypto bad, we have first to ask: what specific aspect of the cryptocurrency industry are you talking about? Then the follow-up question must always be: compared to what?

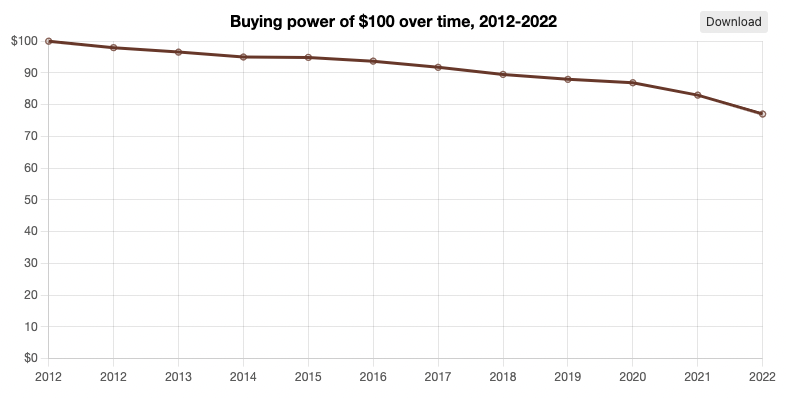

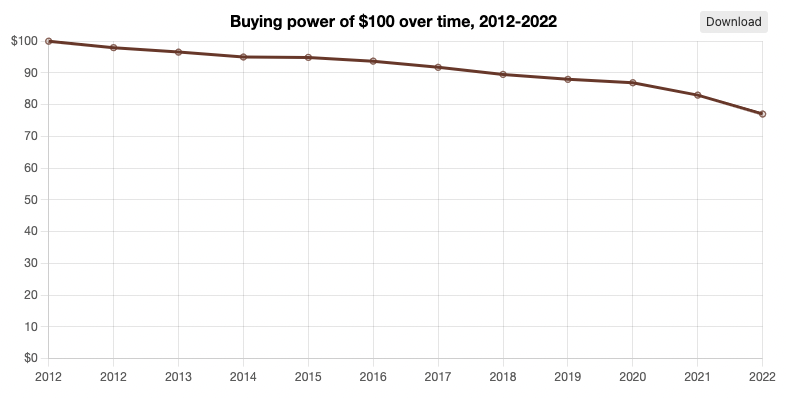

For example, the crypto bad group almost always fails to appreciate the mass-scale redistribution and legal counterfeiting being carried out by the traditional financial institutions and their friends at the Central Bank, even as they pay $4.50 for eggs. In just ten years, for example, the dollar has lost 25 percent of its purchasing power, despite being the world’s reserve currency. At current rates, the dollar will lose half of its purchasing power over the next decade.

Odious Analogy

Before we turn back to the magnificent mess we’re in, let’s consider this description of the FTX/Alameda affair from Michael W. Green.

By simultaneously owning FTX, the exchange, and Alameda Research, the largest trader and market maker on the exchange, SBF was able to dictate the price of the FTT token and create the illusion that the value of the FTT token—and, by extension, FTX and Alameda—was substantial.

…As the crypto boom turned to bust, the need to support FTT amid unbearable losses across the crypto universe led FTX’s affiliated trading arm, Alameda Research, to buy far more FTT than it sold. That left its balance sheet composed almost exclusively of FTT tokens.

But once SBF’s financials leaked, the value of the FTT token dropped like SBF’s gynecomastia.

Now, the venerable economist Arnold Kling puts the analogy quite starkly:

Let’s retell this story using entities of the U.S. government. The Treasury is like FTX, issuing tokens that it calls bonds. The Fed is like Alameda Research, taking these tokens on its balance sheet to try to support their price.

You’re going to say, ‘Wait. The Fed is issuing its own tokens, called money. The analogy does not hold.’

But Quantitative Easing did not work by issuing money. Instead, the Fed borrowed from banks, by paying interest on reserves and doing ‘reverse repos.’ Just like Alameda Research, it took a levered position in Treasury tokens. Now the Fed is bankrupt. It has to be bailed out by the Treasury (you and me). Unlike FTX, the Treasury can still get away with issuing tokens.

You see? Treasury is like FTX. The Fed is like Alameda. SBF learned from the best.

The Interventionist Hegemons

We might wonder how long, due to the dollar’s exorbitant privilege as the world’s reserve currency, traditional finance’s titanic shell game can go on. Whatever you think about BRICS, they’re creating their own energy, economic bloc and their own reserve currency, which will likely compete against the eurodollar and petrodollar. Twelve new nations have signed on, making it more likely that signatory countries will decouple from the dollar hegemon.

But even if these countries do not so decouple, the world is swimming in red ink. System leverage is about three times larger than the annual economic output of the entire planet. Just look at the UK, whose Bank of England had to intervene to protect pension funds. Japan continues to intervene with yield curve controls. Intervention begets intervention. Other countries are having trouble paying their dollar-denominated debt service, so the possibility of a global contagion looms.

Can the economy hold up under all the problems and interventions that seem to increase in frequency? I cannot say. But as the Federal Reserve rolls out the digital dollar, the government and Central Bank will have unprecedented control over our lives.

We can’t assume their competence, nor that they have our best interests at heart. That is why we must keep pushing for decentralization in all its forms.

The Phoenix

What then of crypto? The better question to ask, even for the uninitiated, is to ask: what then of Bitcoin, Monero, or any other cryptocurrency designed specifically to shield holders from the interventions and shenanigans of governments and central banks? After all, the greatest heist in history is ongoing (and it’s completely legal).

Take Bitcoin. It’s a solidarity commodity. That’s a term I coined (no pun), but it means that, like any scarce resource with a fixed supply, the price will increase as more people acquire units. So long as those same people trade and hold bitcoin, its price will remain stable. It is sound by design, not by fiat. Through solidarity, bitcoin’s deflationary nature is revealed. It’s unwise to get greedy and use it in exotic debt instruments or fractional reserve schemes a la 2008 because, as finance guru Caitlin Long cautions, “a fool and his leveraged bitcoin are soon parted.”

Such is not to argue that no future decentralized finance (defi) systems will offer security, transparency, and risk mitigation. It is rather to say that “crypto” is not some monolithic thing, and today’s evolutionary pressures on the ecosystem by private and public predators are likely to result in a Cambrian explosion of solutions that make it a far more secure, resilient and decentralized industry.

In other words, people can keep crying crypto bad, but there might soon be nowhere else to turn except gold, guns, and goats. If that day comes, we will want to have done our due diligence on the specifics.

Exitus Acta Probat

The ends justify the means. Such is the essence of utilitarianism’s dark side. Whether in the wokish shibboleths of effective altruists like SBF or the turgid justifications for total political control of the fiat money system, scoundrels will always evoke exitus acta probat in some form or other. They might cloak their ambitions in sanctimonious newspeak, but at the end of the day, they want to rob you.

Passing over the ironic examples of hypothetical rich people on hypothetical “Lucky Island,” here’s SBF’s mom, legal theorist Barbara Fried, attempting to justify the expropriation and redistribution of wealth by, she thinks, hoisting contractarian academics on their own petard:

One is pushed toward the conclusion, that is, that such constraints [on realistic exit options] are morally akin to the weather. In that view, ‘If you don’t like it, leave it,’ is a perfectly acceptable response to the privileged members of a society subject to a redistributive scheme they don’t like, but for whom exit is not a socially realistic option.

Fried published the above five years before the bitcoin whitepaper, twenty years before her son got caught on Lucky Island. She thinks predatory states are justified in their predation, because democracy. Ironic, then, that her son was peddling effective altruism and paying regime politicians and pundits in the “existing institutions” for their protection.

Exit

Despite SBF’s sins, “crypto” might be one of the few realistic exit options any of us has, as the Fed busts and the Treasury seeks to bail it out with stolen goods. But be warned: crypto is an ecosystem. We must evaluate its systems, subsystems, and properties through the lens of self-sovereignty.

Then we must be good. And HODL.