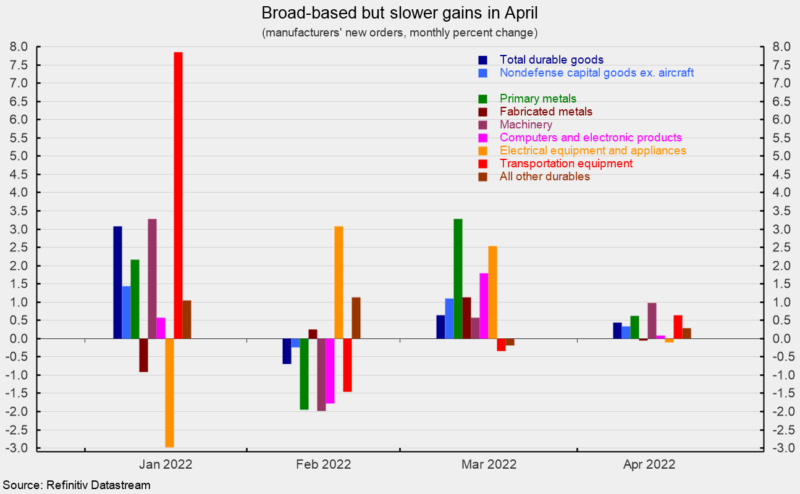

New orders for durable goods increased 0.4 percent in April following a 0.6 percent gain in March, the sixth increase in the last seven months. Total durable-goods orders are up 9.7 percent from a year ago. The April gain puts the level of total durable-goods orders at $265.3 billion, the second highest on record (see first chart).

New orders for nondefense capital goods excluding aircraft, or core capital goods, a proxy for business equipment investment, rose 0.3 percent in April after jumping 1.1 percent in March. Orders are up 10.6 percent from a year ago with the level at $73.1 billion, a new record high (see first chart). However, accelerating price increases have an impact on capital goods orders. In real terms, after adjusting for inflation, new orders for nondefense capital goods were $45.7 billion in March, measured in 1982 dollars, a high level by historical comparison but well shy of the record high (see first chart). Furthermore, producer prices for consumer durable goods rose 0.9 percent in April while producer prices for capital equipment rose 1.2 percent, suggesting that in real terms, new orders for durable goods may have declined in April.

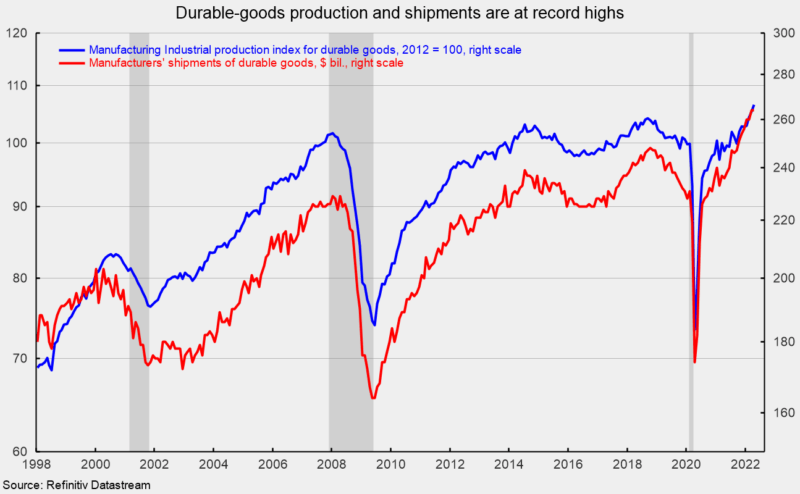

Nearly every category (five of seven) in the durable-goods report showed a gain in April, though the increases were modest. Among the individual categories, machinery orders led with a 1.0 percent increase, followed by transportation equipment and primary metals, both with 0.6 percent increases, all other durables with a 0.3 percent increase, and computers and electronic products with a 0.1 percent rise. Within the transportation equipment category, motor vehicles and parts were off 0.2 percent, but nondefense aircraft was up 4.3 percent, and defense aircraft gained 1.0 percent. Fabricated metal products and electrical equipment and appliances were both down 0.1 percent (see second chart). From a year ago, every major category shows a solid gain.