Sales of existing homes fell 2.0 percent in August, to a 5.88 million seasonally adjusted annual rate. Sales are down 1.5 percent from a year ago. Sales in the market for existing single-family homes, which account for about 88 percent of total existing-home sales, fell 1.9 percent in August, coming in at a 5.19 million seasonally adjusted annual rate (see top of first chart). From a year ago, sales are down 2.8 percent. Condo and co-op sales fell 2.8 percent for the month, leaving sales at a 690,000 annual rate for the month versus 710,000 in July (see top of first chart). From a year ago, condo and co-op sales are still up 9.5 percent.

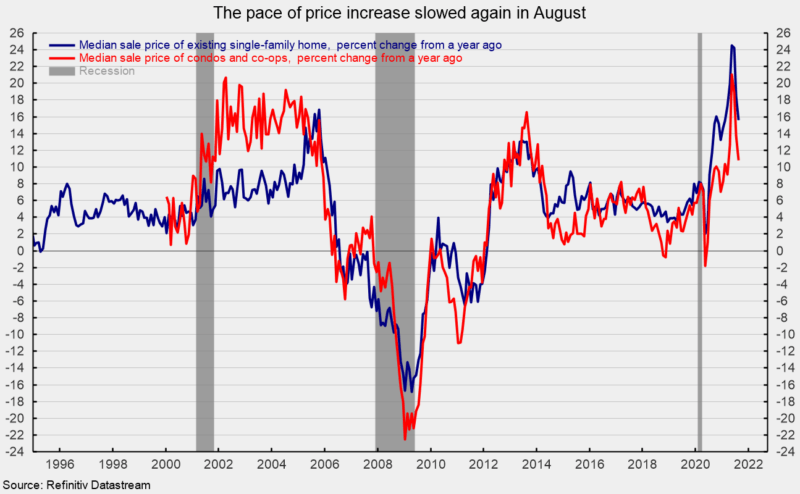

The median sale price in August of an existing home was $356,700, 14.9 percent above the year ago price. The pace of gain has slowed over the last few months since hitting a pace of 23.6 percent in May.

For single-family existing home sales in August, the price was $363,800, a 15.6 percent rise over the past year. That pace is down from 18.4 percent in July and 24.5 percent in May (see second chart).

The median price for a condo/co-op was $302,800, 10.8 percent above August 2020 but slower than the 12-month gain of 13.8 percent in July and 21.0 percent in May (see second chart).

Total inventory of existing homes for sale also fell in August, declining 1.5 percent to 1.29 million, leaving the months’ supply (inventory times 12 divided by the annual selling rate) unchanged at 2.6, tying the highest since September 2020, though still a very low supply by historical measure.

For the single-family segment, inventory decreased 0.9 percent to 1.12 million and is 11.8 percent below the August 2020 level. The months’ supply was unchanged at 2.6 (see bottom of first chart).

The condo and co-op inventory fell 1.7 percent to 173,000, leaving the months’ supply at 3.0 (see bottom of first chart).

High prices are pushing some buyers out of the market, helping to slow sales. However, inventory also remains low, keeping months’ supply near record lows. Furthermore, some fading of the rush out of dense urban areas for suburban housing or rural country homes may be undermining housing demand though the rebound in Covid cases related to the Delta variant may provide renewed interest by consumers. Housing is likely to be volatile over the coming months as fundamentals adjust to changing market conditions.