Despite fears of overtightening and calls for the Federal Reserve to ease up, Chair Jerome Powell insists the Fed will stay the course to bring down inflation. “It’s premature to discuss pausing,” Powell told reporters following the November Federal Open Market Committee (FOMC) meeting. “It’s not something that we are thinking about. That’s really not a conversation to be had now. We have a ways to go.”

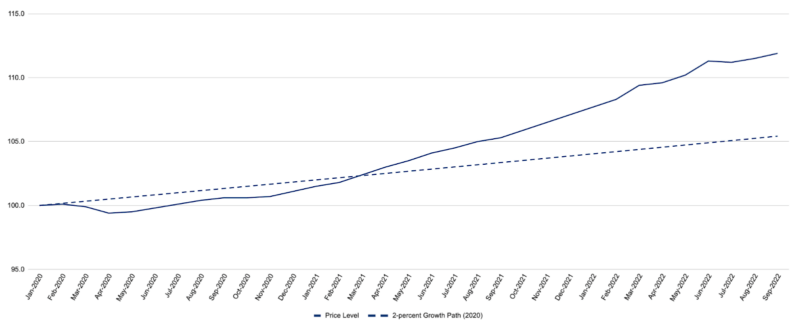

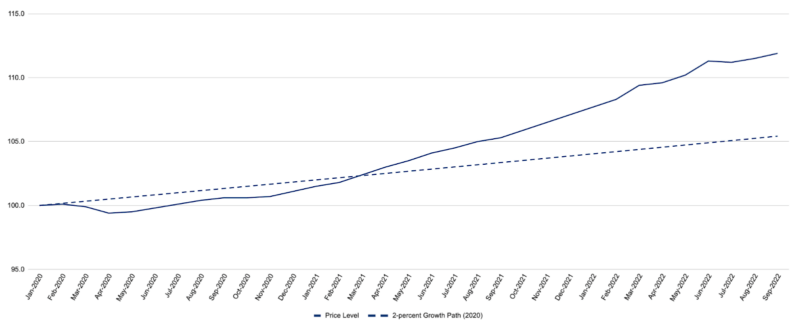

The personal consumption expenditures price index (PCEPI), which is the Fed’s preferred measure of inflation, continues to grow much faster than Fed officials would like. The price level grew at a continuously compounding annual rate of 6.1 percent from September 2021 to September 2022. It has grown at a continuously compounding annual rate of 4.2 percent since January 2020. Prices today are 6.5 percentage points higher than they would have been, had the Fed delivered on its 2-percent inflation target over the period.

Core inflation, which excludes volatile food and energy prices and is thought to be a better predictor of future inflation, has also remained high. Core PCEPI grew at a continuously compounding annual rate of 5.0 percent from September 2021 to September 2022. It grew at an annualized rate of 5.5 percent over the prior month, 4.0 percent over the prior three months, and 4.8 percent over the prior six months. To the extent that core inflation is a good guide, it suggests that monetary policy has not been sufficiently restrictive to date.

The Fed has raised its federal funds rate target considerably over the last few months. In early March, the target range was 0.00 to 0.25 percent. Following the most recent FOMC meeting, the target range stands at 3.75 to 4.00 percent. How can one claim that six hikes totaling 375-basis points over the last nine months have not been sufficiently restrictive?

Remember the Fisher equation: i = r + E(π), where i is the nominal interest rate, r is the real (inflation-adjusted) interest rate, and E(π) is expected inflation. Unless the Fed’s nominal interest rate target exceeds expected inflation, the implied real interest rate target is negative. Suppose market participants set inflation expectations over the next month equal to core inflation from the prior month–i.e., at 5.5 percent. That would imply the Fed’s 3.75 to 4.00 percent nominal interest rate target is a -1.75 to -1.5 percent real interest rate target.

The neutral real interest rate is thought to be around 0.25 percent, suggesting the Fed may need to raise its nominal interest rate target another 175 to 200 basis points just to get to neutral.

Powell said as much at the recent press conference. He identified three questions:

- How quickly should the Fed raise its interest rate target?

- How high should its interest rate target ultimately be raised in order to be sufficiently restrictive?

- How long should the Fed hold its interest rate target at this sufficiently restrictive level?

Powell credited the Fed with moving at “a historically fast pace” since March, which is “certainly appropriate given the persistence and strength of inflation and the low level [of interest rates] from which we [the Fed] started.” Now, Powell said, the Fed must grapple with the second question.

“We think there is some ground to cover,” Powell told reporters. “Incoming data between the meetings—both the strong labor market report and particularly the CPI [consumer price index] report—do suggest to me that we may ultimately move to higher [interest rate target] levels than we thought at the time of the September meeting.”