Federal Reserve officials say they are ready to tighten the stance of monetary policy. According to the December Federal Open Market Committee (FOMC) meeting minutes, there was widespread agreement among participants that the federal funds target should increase soon. Participants at the meeting also “began to discuss how balance sheet policy might feature in the Committee’s plan for reducing accommodation when warranted, although expectations for timing of the first decline in the balance sheet were diffuse [emphasis mine].” In short, we should expect modest increases in the federal funds target soon, with a reduction of the balance sheet following the increase in rates. The exact timing of balance sheet reduction is yet to be determined.

The shift in tone at the FOMC reflects the responsibility of the committee to maintain the Federal Reserve’s dual mandate. The Fed is tasked with promoting price stability and maximum employment. The Federal Reserve’s average inflation target is 2 percent. It does not specify an explicit employment target, but economic theory suggests it should try to keep unemployment at its natural rate. The natural rate of unemployment can be thought of as the efficient level of unemployment. It includes structural unemployment – where there is a mismatch between workers’ skills and the skills desired by employers – and frictional unemployment – where workers remain unemployed as they search for a job that suits their skills and a wage that matches the value they can provide with that skill set. We do not observe the natural rate of unemployment directly, and it might vary over time, but estimates usually fall between 4 and 5 percent. In what follows, I assume that the natural rate of unemployment is 4.5 percent.

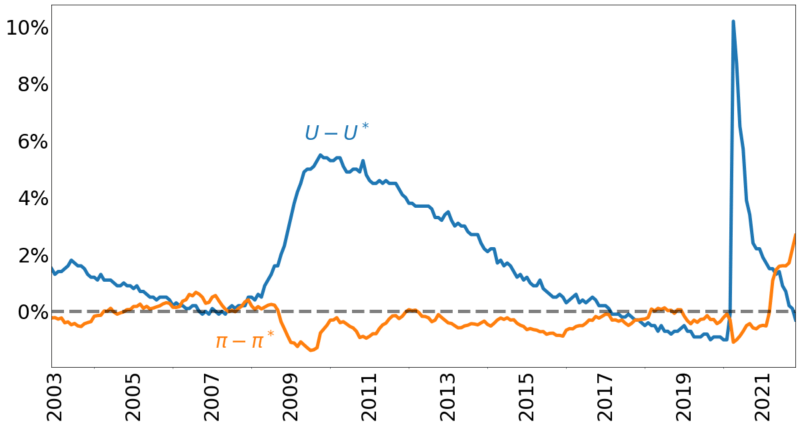

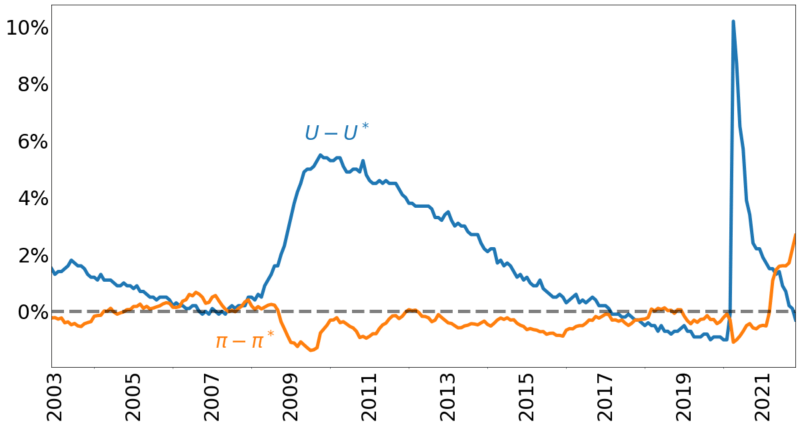

In evaluating whether the Fed should ease, tighten, or maintain the stance of monetary policy, we need to consider the rate of inflation relative to target, and the unemployment rate relative to the natural rate. We also must consider the impact of policy on investor expectations. To evaluate whether the Federal Reserve is meeting its objectives, we can simply take the difference between the observed rates of inflation (π) and unemployment (U), and the desired rates of inflation (π*) and unemployment (U*). We call these the inflation (π-π*) and unemployment (U-U*) gaps.