The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index fell to 50.9 percent in September, barely above the neutral 50 level. September is the 28th consecutive reading above fifty, but the lowest since May 2020 (see the first chart).

Several key component indexes were also close to or below neutral in September, including the new orders index, the production index, the new export orders index, the prices-paid index, and the supplier deliveries index. According to the report, “The U.S. manufacturing sector continues to expand, but at the lowest rate since the pandemic recovery began. Following four straight months of panelists’ companies reporting softening new orders rates, the September index reading reflects companies adjusting to potential future lower demand.”

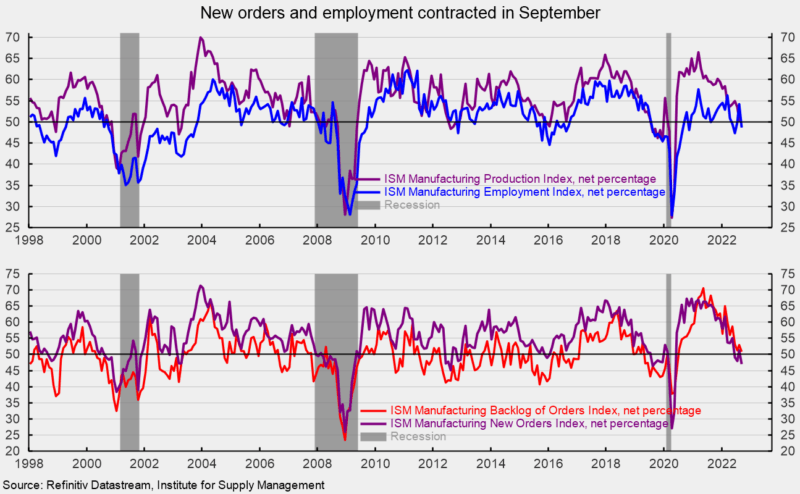

The new orders index fell by 4.2 points to 47.1 percent in September, the third reading below neutral in the last four months. The result suggests orders contracted again in September (see the bottom of the second chart). The new export orders index, a separate measure from new orders, remained below neutral at 47.8 percent versus 49.4 percent in August. The latest reading is the second consecutive month below neutral.

The Backlog-of-Orders Index came in at 50.9 percent versus 53.0 percent in August, a 2.1-point fall (see the bottom of the second chart). This measure has pulled back from the record-high 70.6 percent result in May 2021 but has been above 50 for 27 consecutive months. The index suggests manufacturers’ backlogs continue to rise, but the pace is quite weak.

The Production Index registered a 50.6 percent result in September, gaining 0.2 points from August (see the top of the second chart). The index has been above 50 for 28 months but remains very close to neutral.

The Employment Index fell sharply in September, falling back below the neutral threshold. The 48.7 percent reading suggests payrolls contracted in the manufacturing sector in September (see the top of the second chart). The report states, “Labor management sentiment shifted in September, with a higher number of panelists’ companies pausing hiring through hiring freezes and allowing attrition to reduce employment levels. Turnover rates eased, with 28 percent of comments citing backfill and retirement issues, a decrease from 33 percent in August.” Among the six big sectors in the survey, only two reported expanded payrolls in September.

The Bureau of Labor Statistics’ Employment Situation report for September is due on Friday, October 7, and expectations are for a gain of 250,000 nonfarm payroll jobs, including the addition of 20,000 jobs in manufacturing. Customer inventories in September are still considered too low, with the index coming in at 41.6 percent, up 2.7 points from August (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 72 consecutive months. Insufficient inventory is a positive sign for future production.

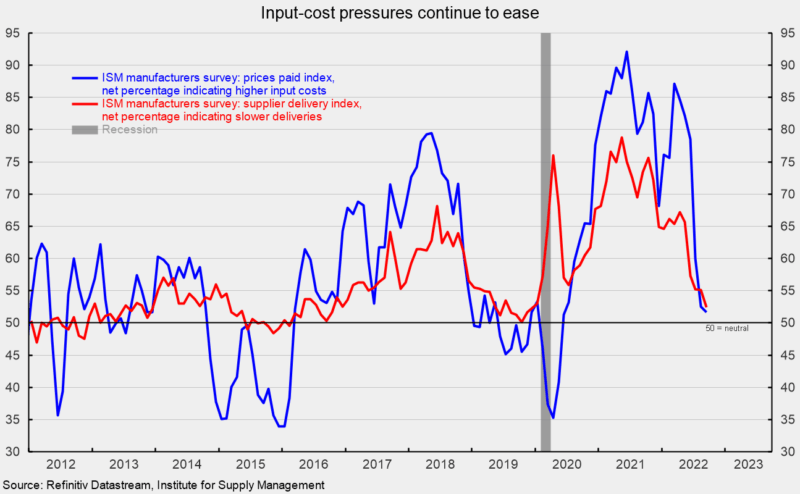

The supplier deliveries index registered a 52.4 percent result in September, down 2.7 points from August and the lowest reading since December 2019. The index was at 78.8 percent in May 2021. The easing trend over the past 16 months suggest delivery lead times are slowing at a much slower rate (see third chart).

The index for prices for input materials sank again, dropping another 0.8 points to 51.7 in September and is the sixth consecutive monthly decline (see third chart). The index is down from 87.1 percent in March 2022 and is at the lowest level since June 2020. The result suggests price pressures have eased significantly. The report notes, “This is the second consecutive month the Prices Index registered below 60 percent, a level not seen since August 2020 (59.5 percent), and this is also the lowest reading since June 2020 (51.3 percent). Over the past six months, the index has decreased 35.4 percentage points, including a combined 26-percentage point plunge in July and August.” The report adds, “The slowing in price increases is being driven by continued (1) relaxation in the energy markets, (2) softening in the copper, steel, aluminum and corrugate markets and (3) continuing sluggishness in chemical and plastics demand. Notably, 28.1 percent of respondents reported paying lower prices in September, compared to 26.7 percent in August.”

The manufacturing sector is showing clear signs of weakness though not collapse. Economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, and continued fallout from the Russian invasion of Ukraine. The outlook remains highly uncertain. Caution is warranted.