States are traditionally thought of as reliable borrowers. This might seem ironic since a state, backed by control over the use of force, is also in a privileged position to renegotiate terms of repayment. Consider that King James I and King Charles I both delayed repayment of loans, many years failing to repay any principal or interest.

After the Glorious Revolution, however, Parliament was the dominant party in British governance, removing and replacing kings whenever its members thought it appropriate. And with the stability of this position, Parliament oversaw the largest sustainable expansion of public borrowing in history. Between 1618 and 1750, the size of the public debt increased about 100-fold, and the interest rate paid on the public debt hovered around only 3%.

The tradition of seeing the state as a reliable borrower has continued into the present. In the United States the federal debt is currently greater than the size of US GDP, even if debt owned by the Federal Reserve and federal agencies is not included in this calculation. Yet, even in spite of the size of federal debt, the federal government continues to be a favored borrower in financial markets.

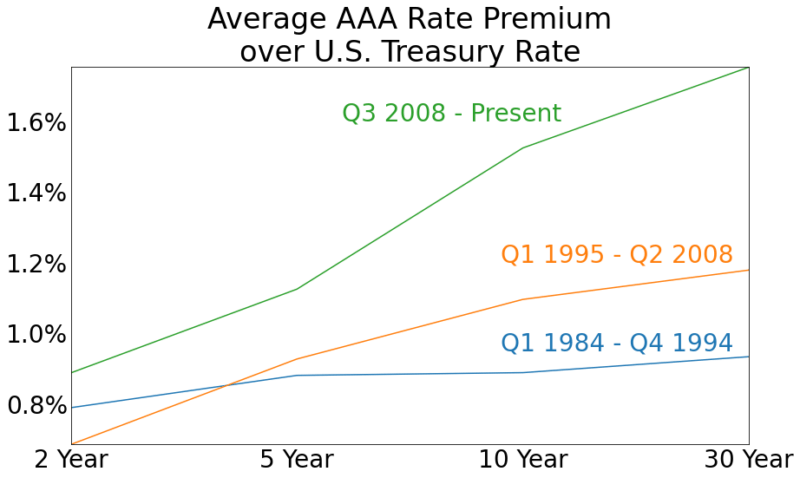

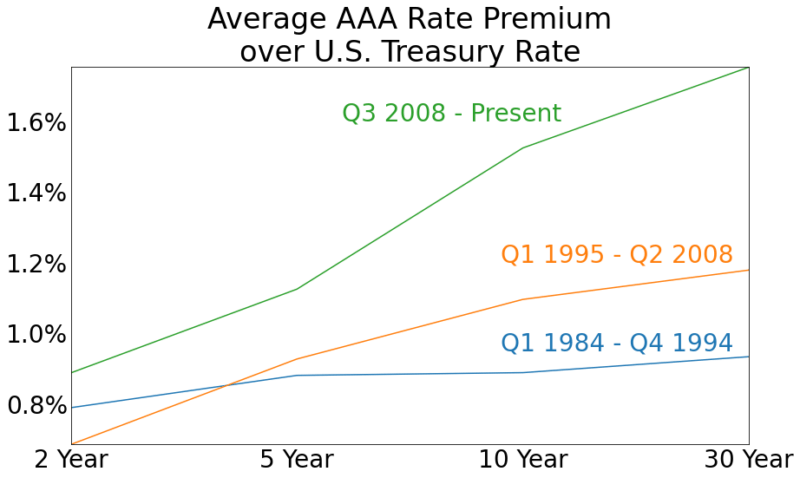

Premium on Private Borrowing

One way to judge the extent to which the federal government is a favored borrower is to compare the rate paid on public debt for a given maturity to the rate paid on private debt of the same maturity. We need only compare yield curves for federal debt and high quality private debt. The more elevated the private yield curve compared to the public yield curve, the greater the premium indicated by the difference between the two curves.