Initial claims for regular state unemployment insurance fell 8,000 for the week ending May 21, coming in at 210,000 (see first chart). Claims have now decreased in four of the last seven weeks but the decreases, averaging -5,000, are much smaller than the three increases which have averaged 20,000. Over the last seven weeks, initial claims have increased by a net 42,000. However, by long-term historical comparison, initial claims remain extremely low.

The four-week average rose for a seventh consecutive week, coming in at 206,750, up 7,250 from the prior week and at the highest level since March 12th. Weekly initial claims data continue to suggest a very tight labor market, though the recent upward trend is a concern. The Russian invasion of Ukraine, renewed lockdowns in China, and a new Fed tightening cycle are likely to continue distorting the global economy over coming months.

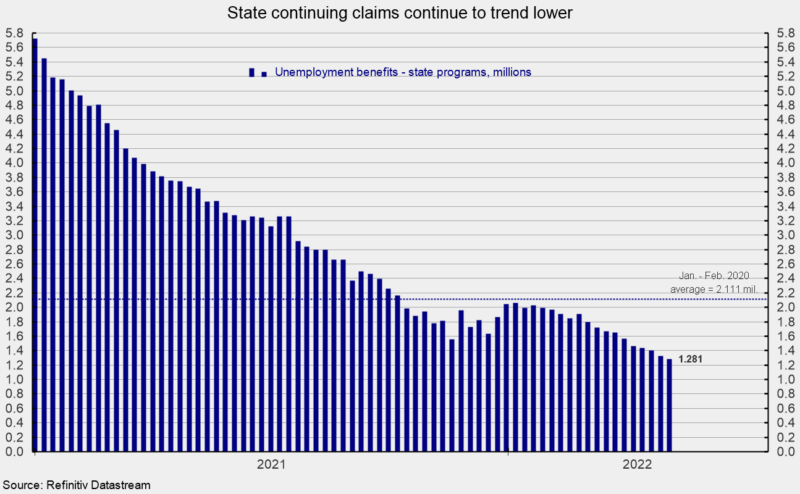

The number of ongoing claims for state unemployment programs totaled 1.281 million for the week ending May 7, a drop of 49,777 from the prior week (see second chart). State continuing claims have declined in 15 of the past 17 weeks and have been below their pre-pandemic level of 2.111 million since October 2021 (see second chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.317 million for the week ended May 7, a decrease of 54,282 from the prior week. The latest result is the thirteenth week in a row below 2 million.

Initial claims remain at an extremely low level by historical comparison, but recent weeks have seen an upward trend become more apparent. The trend may be temporary or may be an early warning sign. The overall low level of claims combined with the record-high number of open jobs suggest the labor market remains very tight. The tight labor market remains one of the strongest parts of the economy, providing support for consumer attitudes and consumer spending. However, persistent price increases are starting to work against consumer attitudes. Continuing labor shortages, along with materials shortages and logistical issues, are likely to continue to hamper the growth in production across the economy and sustain upward pressure on prices. In addition, the Russian invasion of Ukraine, renewed lockdowns in China, and the start of a new Fed tightening cycle will continue to weigh on global economic activity. The outlook remains highly uncertain.