After two worrisome months, we are finally getting some better news on the inflation front. The Personal Consumption Expenditures Price Index (PCEPI) grew at a continuously compounded annual rate of 3.2 percent in February, down from 6.9 percent in January. PCEPI inflation was just 2.1 percent in November 2022 and 2.4 percent in December 2022. Monthly inflation in January was the highest it had been since June 2022. Although inflation is still 1.1 percentage points higher than it was in November 2022, it is at least headed in the right direction.

Core PCEPI, which excludes volatile food and energy prices and is believed to be a better predictor of future inflation rates, also declined. Core PCEPI inflation was just 3.6 percent in February. In January, core PCEPI grew 6.2 percent—1.7 percentage points faster than in December 2022 and 3.5 percentage points faster than in November 2022.

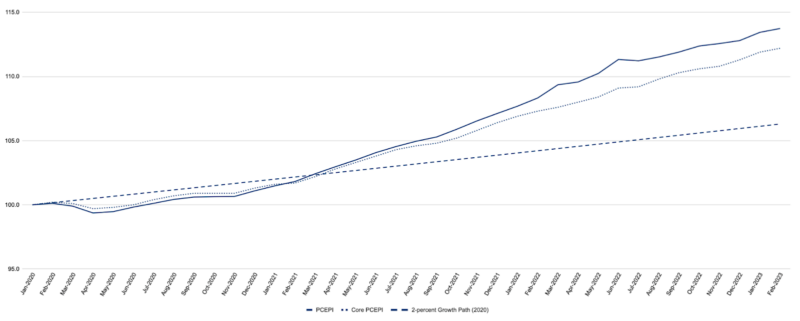

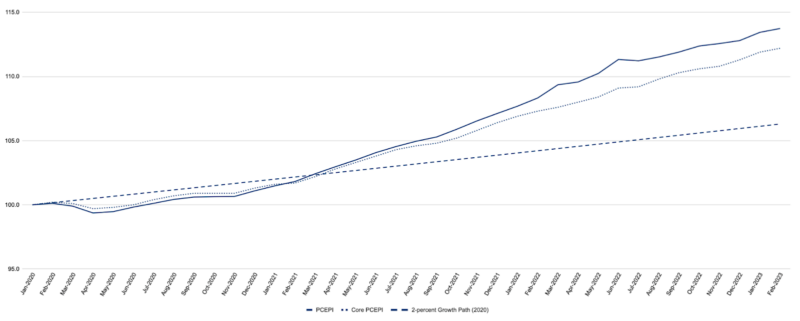

Figure 1. Headline and Core PCEPI, January 2020 – February 2023

The PCEPI price level has grown at a continuously compounded annual rate of 4.2 percent since January 2020, just prior to the pandemic. As a result, prices are 7.4 percentage points higher today than they would have been had the Federal Reserve hit its 2 percent inflation target over the period. Core PCEPI has averaged 3.7 percent growth over the period.

Although inflation remains elevated, it finally appears to be consistent with Federal Open Market Committee (FOMC) member projections. The median FOMC member increased their 2023 inflation projection from 3.1 to 3.3 percent in March. However, lower than projected inflation in the last two months of 2022 means the implicit price level projection for December 2023 is more or less unchanged.

FOMC members consistently underestimated inflation from June 2020 to December 2022, and were forced to revise up their projections each quarter.

Table 1. Median FOMC Member Inflation Projections

| Projection Date | 2021 | 2022 | 2023 | 2024 | 2025 | Longerrun |

| June 2020 | 1.6 | 1.7 | 2.0 | |||

| September 2020 | 1.7 | 1.8 | 2.0 | 2.0 | ||

| December 2020 | 1.8 | 1.9 | 2.0 | 2.0 | ||

| March 2021 | 2.4 | 2.0 | 2.1 | 2.0 | ||

| June 2021 | 3.4 | 2.1 | 2.2 | 2.0 | ||

| September 2021 | 4.2 | 2.2 | 2.2 | 2.1 | 2.0 | |

| December 2021 | 5.3 | 2.6 | 2.3 | 2.1 | 2.0 | |

| March 2022 | 4.3 | 2.7 | 2.3 | 2.0 | ||

| June 2022 | 5.2 | 2.6 | 2.2 | 2.0 | ||

| September 2022 | 5.4 | 2.8 | 2.3 | 2.0 | 2.0 | |

| December 2022 | 5.6 | 3.1 | 2.5 | 2.1 | 2.0 | |

| March 2023 | 3.3 | 2.5 | 2.1 | 2.0 |

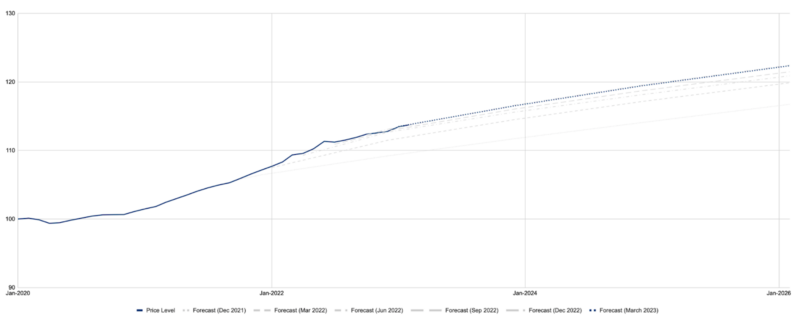

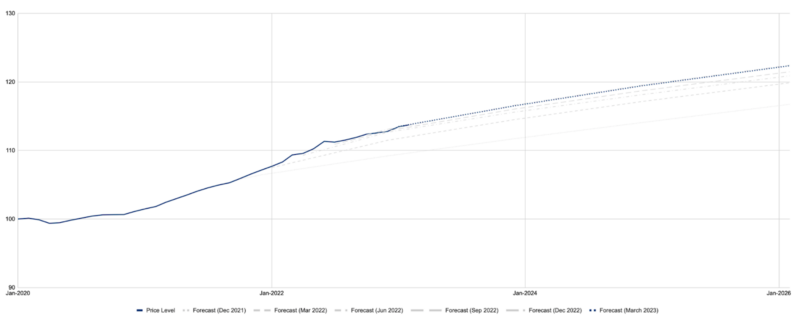

Morgan Timmann and I estimate the price level based on FOMC member projections. If the price level evolves as the median FOMC member suggests it should, prices will be 16.8 percent higher in December 2023 than they were in January 2020, reflecting 3.9 percent average inflation over the period. Prices will be 19.6 percent higher in December 2024, with the average inflation rate from January 2020 to January 2024 falling to 3.6 percent. They will be 22.2 percent higher in December 2025, with average annual inflation since January 2020 of 3.3 percent.

Figure 2. Forecast of the Price Level based on Median FOMC Member Projections

Fed officials have no intention of bringing prices back down to where they would have been had they not grown faster than intended since January 2020. They merely intend to reduce the growth rate of prices to 2.0 percent going forward. They do not project the annual rate of inflation will return to 2.0 percent until after 2025. The average inflation rate since January 2020 will only approach 2.0 percent in the very, very long run.

Many Americans believe inflation has been too high over the course of the pandemic—and I count myself among them. But temporarily higher inflation and permanently higher prices is totally consistent with the Fed’s asymmetric average inflation target, which commits monetary policymakers to make up for undershooting their target but does not require they make up for overshooting their target. This is a recipe for higher-than-target inflation on average, and will fail to anchor long run inflation expectations at 2.0 percent as intended.

Recent experience should prompt calls for the Fed to adopt a symmetric average inflation target when it reevaluates its mandate in 2024 and 2025.