Federal Reserve officials pride themselves on making data-dependent decisions using the most up-to-date information on the state of the economy. Fed Chair Jerome Powell says that the Fed “has gone to great lengths to collect and rigorously analyze the best information to make sound decisions for the public we serve.”

Sound monetary policy decisions, however, require not only recent data on the economy but also predictions about its future direction. As Milton Friedman described, monetary policy works in “long and variable” lags, often of a year or more. To manage the money supply effectively, the Federal Open Market Committee (FOMC) must have accurate predictions of the economy in order to make informed policy decisions.

Let’s look at the Fed’s economic forecasts during the Great Recession of 2007-2009 and consider how they might have affected its monetary policy decisions.

Before the recession

Most research prior to the Great Recession found the Fed’s forecasts to be quite accurate. Research by Christina and David Romer, for example, found that forecasts by the Federal Reserve Board (FRB) staff’s economic models outperformed private forecasts and were even better than projections by the individual FOMC members.

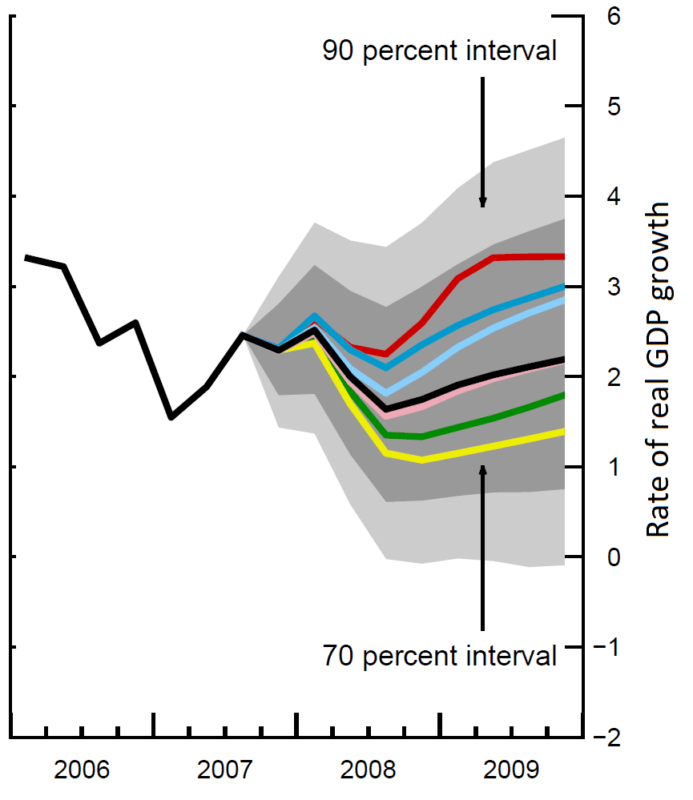

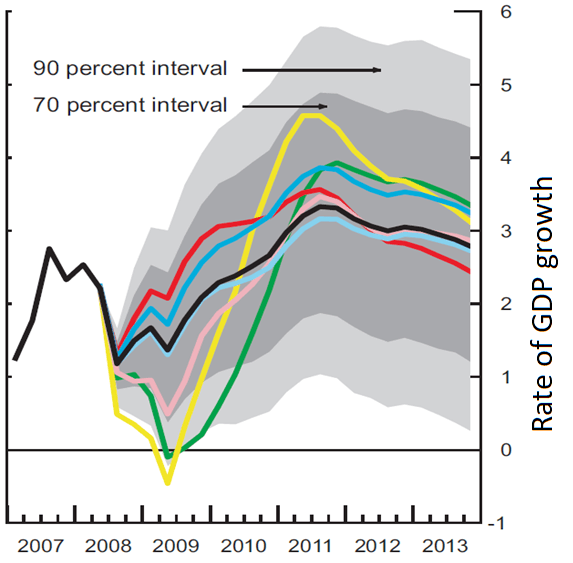

However, recent research including the time period of the Great Recession finds much different results. Figure 1 shows the FRB staff’s forecast of GDP growth as of October 2007, just prior to the start of the recession. The black line is the base-case forecast of the four-quarter percentage change in real GDP growth. The colored lines represent alternative scenarios based on different assumptions. The dark and light gray areas respectively represent the 70 percent and 90 percent confidence intervals.

Figure 1. FRB staff GDP growth forecast, October 2007

The FRB staff’s base-case forecast was fairly stable around 2 percent GDP growth through the end of 2009. The 90 percent interval barely touched zero in 2008 and 2009, indicating that the FRB staff was almost 90 percent confident there would not be a recession. Obviously, that forecast was very wrong.

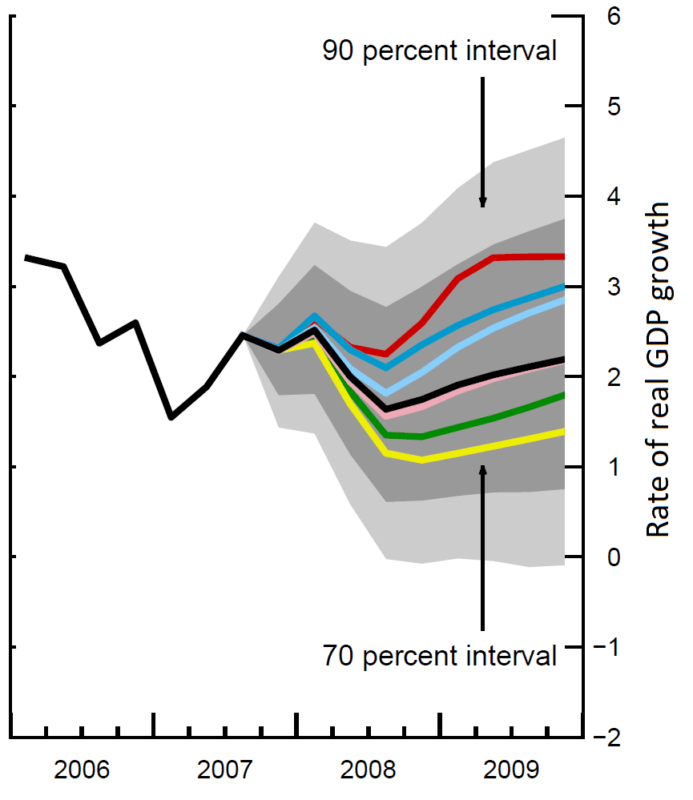

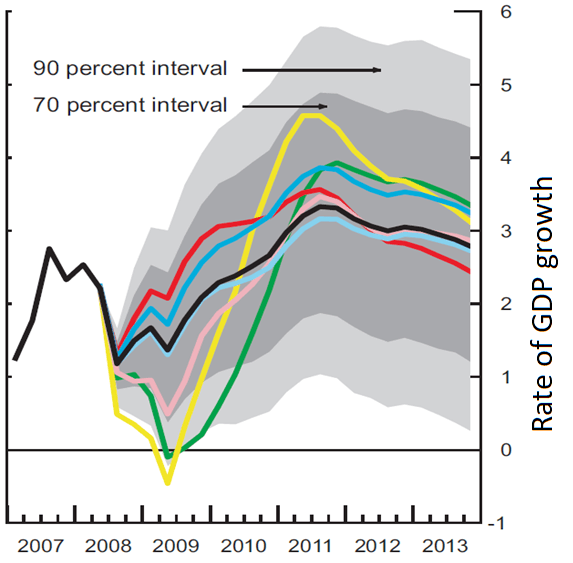

Figure 2. Actual GDP growth vs. FRB staff forecast, October 2007

Figure 2 shows the FRB staff’s base-case forecast in addition to a dashed line representing the actual rates of GDP growth over the period. Clearly the FRB staff forecast was quite different from the actual rates, which were below the FRB’s 90 percent confidence interval for most of 2008 and 2009.

During the recession

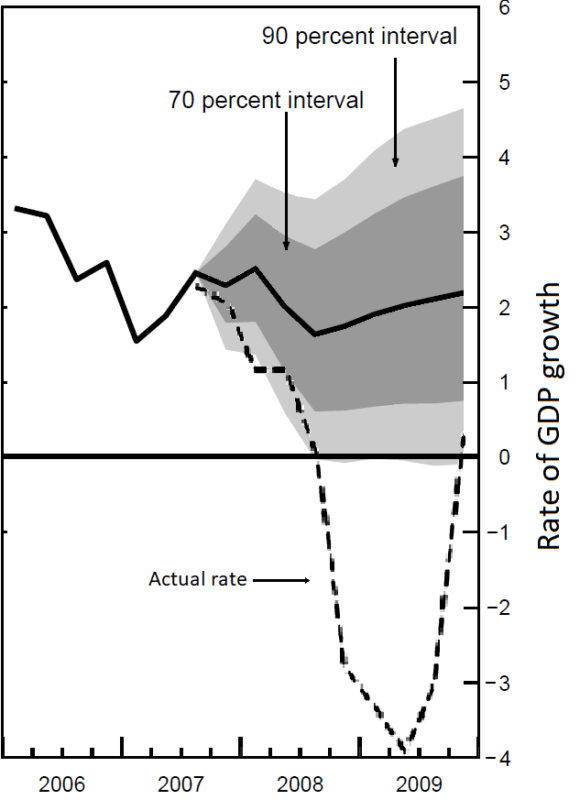

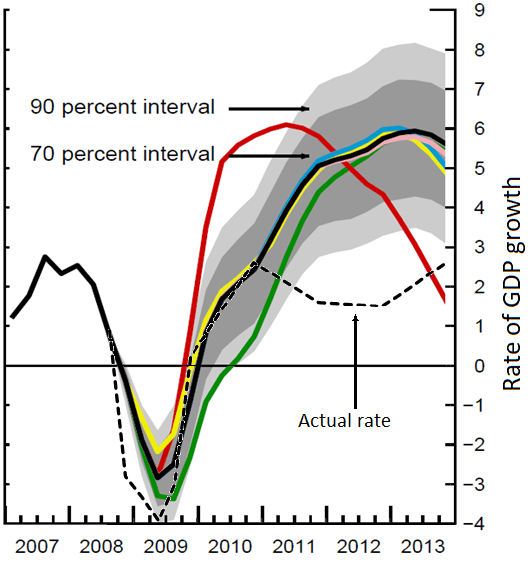

The FRB staff’s forecast errors persisted throughout the recession. Figure 3 shows the FRB staff’s forecast from September of 2008. Again, the black line represents the base-case forecast, and the colored lines are alternative scenarios. Though slightly obscured, the light gray area appears to only briefly fall below zero, again indicating that the FRB staff was 90 percent confident we would avoid a recession.

Figure 3. FRB staff GDP growth forecast, September 2008

According to data from the National Bureau of Economic Research, the recession officially began in December of 2007. The forecast in Figure 3 is from September of 2008, the tenth month of the recession.

The economy had been in recession for 10 months, and the Fed staff was still predicting there would be no recession!

The FRB staff’s overoptimistic forecasts were partly due to overconfidence in the Fed’s monetary policy. In early 2008, the FOMC adopted a more expansionary policy by reducing its interest rate target from 4.25 percent in early January to 2.25 percent by late March.

The FRB staff’s models predicted that this policy change would be sufficient to avoid a recession. For this reason, the FOMC left its target practically unchanged for the next six months until after the peak of the financial crisis in September 2008.

Had Fed officials realized the extent of the economic downturn, they almost certainly would have pursued more expansionary monetary policy. In his autobiography, for example, Fed Chair Ben Bernanke said that the decision to leave rates unchanged in September of 2008 “was almost certainly a mistake.”

A quick recovery?

It could be argued that the failure to foresee the downturn of the Great Recession was a one-time event and that Fed economists should not be held at fault. Economic shocks are, by their nature, unpredictable. But even once they recognized the depth of recession, the FRB staff continued to wildly overestimate the future rates of GDP growth.

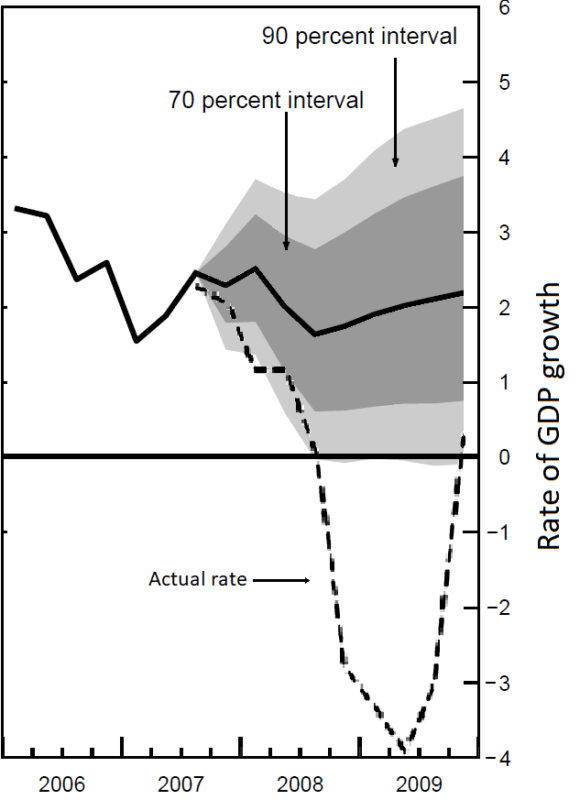

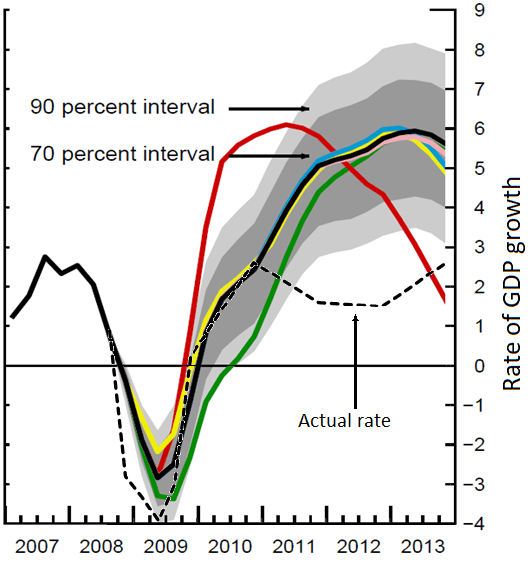

Figure 4 shows the FRB staff’s GDP forecast as of December of 2008, which finally shows a major recession in 2008-2009. However, the base-case forecast as well as each of the alternative scenarios all predicted a huge rebound following the recession. Each scenario reaches about 6 percent growth by 2013. That obviously did not happen. The actual rate of real GDP growth in 2013 was just 1.57 percent.

Figure 4. FRB staff GDP growth forecast, December 2008

What is particularly interesting about Figure 4 is the narrowness of the 90 percent confidence interval shown in light gray, which reaches as high as 8 percent in 2012. On the lower end, the 90 percent interval in 2012 appears to be above the post-World War II average of 3.1 percent, meaning that the FRB staff was more than 90 percent confident that GDP growth would exceed 3.1 percent in those years.

Fed economists believed that 8 percent GDP growth in 2012 was more likely than 3 percent! And even 3 percent is almost twice as high as the actual rate of 1.57 percent in that year.

What do these mistaken forecasts tell us about monetary policy? First, Fed economists should revise their forecasting models, particularly the FRB/US model which yielded the predictions above. Second, economists should pay more attention to knowledge problems at the Fed. Models of monetary policy typically assume the Fed has a good understanding of the effects of its policies. Clearly, that was not the case in the Great Recession.

More fundamentally, the Fed’s poor forecasting record should make us skeptical of its ability to effectively manage the money supply in times of economic turmoil. It would be prudent to consider structural reforms that might improve FOMC’s decision-making process.

This article is based, in part, on the paper “The Calculus of Dissent: Bias and Diversity in FOMC Projections,” now forthcoming in the journal Public Choice.